The Politics Of CBD In A Technofascist Age

For a plant compound touted as “miraculous,” there’s no shortage of dirty horrors hidden behind the weeds of the online CBD world.

By Maryam Henein

Follow: Twitter | Instagram | Telegram | Gab | Facebook

Truth Lives Here: Rumble | Rokfin | Odysee | Brighteon | Bitchute | YouTube

Websites: MaryamHenein.com | HoneyColony.com | TheHiveWisdom.com

2019: The Year of Playing Whack A Mole

With everyone and their mama selling CBD oil today, including Kim Kardashian and Martha Stewart, it’s safe to say that this highly prized cannabinoid, better known as CBD, has become ‘insanely popular,’ officially making it into the mainstream.

“The hemp and CBD industry has taken off like a rocket ship in 2019,” says Rod Kight, cannabis business attorney.

About 64 million Americans have already tried CBD and almost 3/4 (which would be 75%) found it at least mildly effective, according to Consumer Reports. The hemp-derived CBD market is estimated to be worth $23 billion by 2023.

But while some brands (many substandard) sell this naturally occurring plant constituent without a hitch, others on the front lines of the online dietary supplement CBD space, including my magazine and marketplace Honeycolony.com, have gone through technofascist hell.

“I’ve been doing market research for years and covered everything… This is definitely the craziest market I’ve ever covered,” Bethany Gomez, director of research for the Brightfield Group, told Rolling Stone in September 2018.

CBD: Now You See It, Now You Don’t

CBD dietary supplement manufacturers who sell CBD from industrial hemp exist in a legal gray area when it comes to selling CBD online. For many, the rollercoaster ride began in December 2016, when the U.S. Drug Enforcement Administration (DEA) published a rule that cannabis extracts, including CBD, was an illegal Schedule 1 substance.

Suddenly, hemp with no psychoactive properties was being lumped into the same category as firearms, heroin, and porn. According to the government, CBD was now “dangerous,” offering no medical benefits, despite a growing body of research illustrating otherwise.

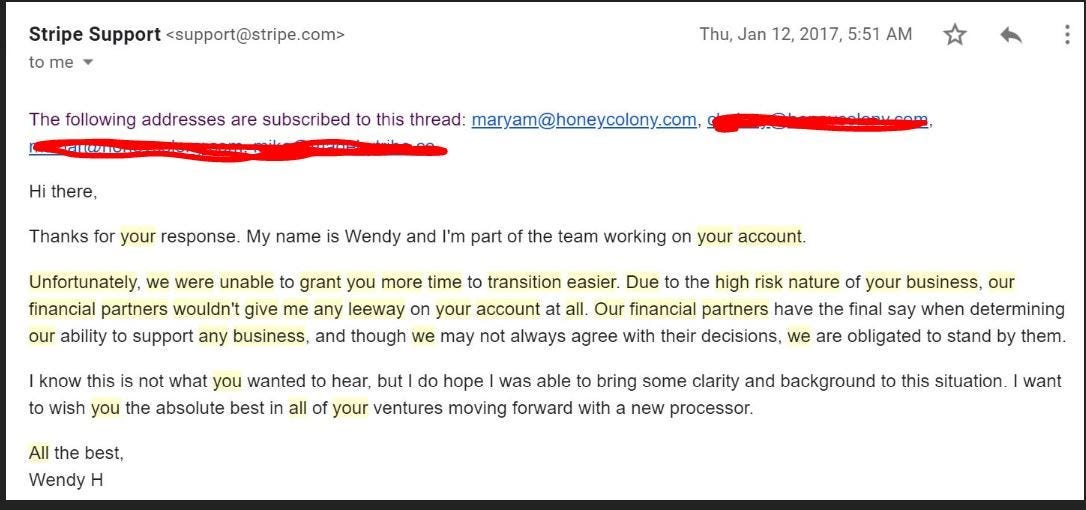

The most common obstructions online companies experienced included successive merchant processors shutdowns (i.e. Paypal, Stripe, Quickbooks), getting blacklisted, being banned from advertising on social media platforms, theft, and fraud.

Back in 2019, we started to get scrubbed off of sites like GoFundMe, and got deranked by Google. Years of hard work quickly disintegrated.

Without a merchant processor, a business’ ability to transact on their e-commerce platform is disabled. Just two weeks of lost income is enough to greatly impact a small business, let alone months on end.

“No one is speaking up about those leading the way in the revolution to legalize CBD and how the system is preventing business owners to take payments in the process,” says Kimber Mc, CEO of multi-brand hemp and CBD distribution company Natural Healthy CBD. “Law-abiding, tax-paying citizens have been without PayPal and most without processing since we’ve been a legal industry.”

I’ve experienced this firsthand. I lost PayPal privileges on my site and I was also personally ‘banned for life’ even though I’ve never sold CBD via my personal account.

A lot of this over-reaction stems from confusion about what exactly CBD is. Cannabidiol (CBD) is a plant compound found in hemp that acts on the body’s own endocannabinoid system (ECS) — a vital “cellular-signaling system” involved in modulating pain, appetite, mood, memory, and cellular life and death cycles — to promote homeostasis. Unlike the compound tetrahydrocannabinol (THC) in marijuana, CBD has no psychoactive properties whatsoever.

“The easiest way to think about it is that CBD is to hemp as THC is to marijuana,” writes the publication Racked. Hemp and marijuana are derived from two different strains of the cannabis plant, but one is grown for its psychoactive effects and the other for industrial purposes. (Although to further confuse things, you can get CBD from marijuana plants that also contain a tiny bit of THC.)

“The concept of putting cannabidiol (CBD) on schedule 1 of the drug schedule, saying that it has no medical use, and it’s highly dangerous, just flies in the face of fact and science and knowledge,” says Dr. Margaret Gedde, a Stanford-trained pathologist, and award-winning researcher.

Ironically, our same government — the US Department of Health and Human Services (HHS) to be exact — also patented CBD as an antioxidant and neuroprotectant in 2003.

It is hypocritical and absurd.

In December of the same year, the Hemp Industries Association, Centuria Natural Foods, and other hemp businesses (collectively, “HIA”), thought so, too, and filed a petition against the DEA seeking a court order either striking down the ruling or clarifying it.

Predictably, the court did neither in rendering its decision on May 1, 2018 — less than two weeks after FDA advisors voted to recommend approval for GW Pharma’s expensive fake CBD called Epidiolex. All was unraveling according to plan: Big Pharma wanted a piece of the action.

(This ruling only refers to CBD oil derived specifically from marijuana, leaving the question about the status of industrialized hemp with less than 0.3% THC, which was supposed to be protected under the 2014 Farm Bill.)

According to Health Freedom News, the Farm Bill of 2014 recognizes that industrial hemp is different from marijuana and allows states to cultivate industrial hemp and CBD. Yet, on December 14, 2016, the Drug Enforcement Agency (DEA) ruled in 2016 that cannabis-derived extracts should be tracked as a Schedule-1 narcotic.

At the core of these challenges exists an arguably asinine system that caters to Big Pharma, hidden agendas, disinformation, fear, corruption, sickness, and greed.

Melissa Mentele, a 40-year old mother of three in South Dakota, has fought to help bring CBD to many sick patients as an alternative to pharmaceutical painkillers.

“… Big Pharma wants to swoop in and use an unfair monopoly and an inferior product to profit off the backs of catastrophically ill and dying people. It is disgusting,” she told Vice in June 2017.

Big Pharma is also arguably aware of the evolving healthcare market that’s drifting away from conventional medicine in favor of holistic and functional approaches.

Consider that the dietary supplement industry is estimated at about $122 billion and growing, according to the Council for Responsible Nutrition, a leading trade association representing dietary supplement and functional food manufacturers and ingredient suppliers.

“A few years ago, the sentiment was that all hemp drugs were snake oil, they were just trying to capitalize on trends,” says Gomez of the Brightfield Group. But it’s debatable whether or not a very sophisticated pharmaceutical product would be more effective than some of these products that are essentially OTC.”

Back by popular demand! Due to overwhelming requests, we have asked the genius behind Superior CBD if she is willing to whip up a small batch small batch for Simply Transformative. Master Herbalist and formulator Eliza Moriarity will be putting together a small batch of only 80 bottles. Get yours today at Simply Transformative!

SUPERIOR CBD is the result of a collaborative effort to develop a novel, 10x bio-availability optimized CBD extract using exclusively natural, plant-based ingredients in a complete botanical formulation. SUPERIOR CBD synergizes with other medicinal herbs used in ancient medicine to create an unprecedented blend in the hemp oil industry.

TERMINATED

From 2015 to 2016, after adding our own premium liposomal organic CBD oil, our online sales blossomed from $200,000 to $1 million. After four years as a startup, our hard work was finally paying off. Sales continued to spike.

Until they didn’t.

I wasn’t alone in seeing this change. Financial institutions started cutting off CBD companies, telling them that hemp was too risky. Many banks didn’t want to get in trouble with the law for providing financial services to the CBD industry.

Instead of running a business, many in the CBD space found themselves frantically plugging up holes as if we were on a sinking ship.

After being shut down five times in six months, many processors wouldn’t even consider taking us. During a virtual operations meeting, I joked, “You’d think we were selling guns or opiates. It’s like we’re on some sort of shit-list.”

It turned out we were.

We were what is called “TMF’d,” a terminated merchant file.

Also called ‘Member Alert To Control High Risk (MATCH),’ this list is used to screen potential applicants, flagging anyone who has had credit card privileges suspended — for any reason.

“It is the most ridiculous thing ever,” Janet Schriever, owner of the CBD skincare line Code of Harmony who is one of those “blacklisted” on MATCH simply for selling CBD products. Mastercard initially created the MATCH List to ban merchants caught engaging in blatantly fraudulent activity. In recent years, though, the list has been used more aggressively in merchant account for CBD products, leading legal experts to assert financial institutions may be overstepping their bounds for CBD payment processing.

“A lot of legitimate merchants are getting [placed on MATCH] right now,” says David J. Bartone, a lawyer whose firm specializes in e-commerce, credit card processing, and credit reporting. “Not all merchants who are placed on MATCH deserve to be.

Bartone also contends there is insufficient due process for those being placed on the MATCH List in merchant account for CBD products. Once on the list, a merchant is not able to obtain a merchant credit account for at least a five year period. It’s very difficult to get off the list before the five years are up. (I know, I’ve tried with the help of my attorney).

“I really do think the MATCH List is something that is a trade libel and something that is also used as a potential extortion tool in many respects, adds Bartone “To drive someone out of business, I think, has legal consequences.”

Eventually, we found a “merchant support facilitator” to help us circumvent MATCH if we agreed to certain restrictions such as getting paid once a week instead of every day and creating an entirely new website, SimplyTransformative, to solely house CBD offerings.

Offshore Solutions: Bruce Lee & The China Express

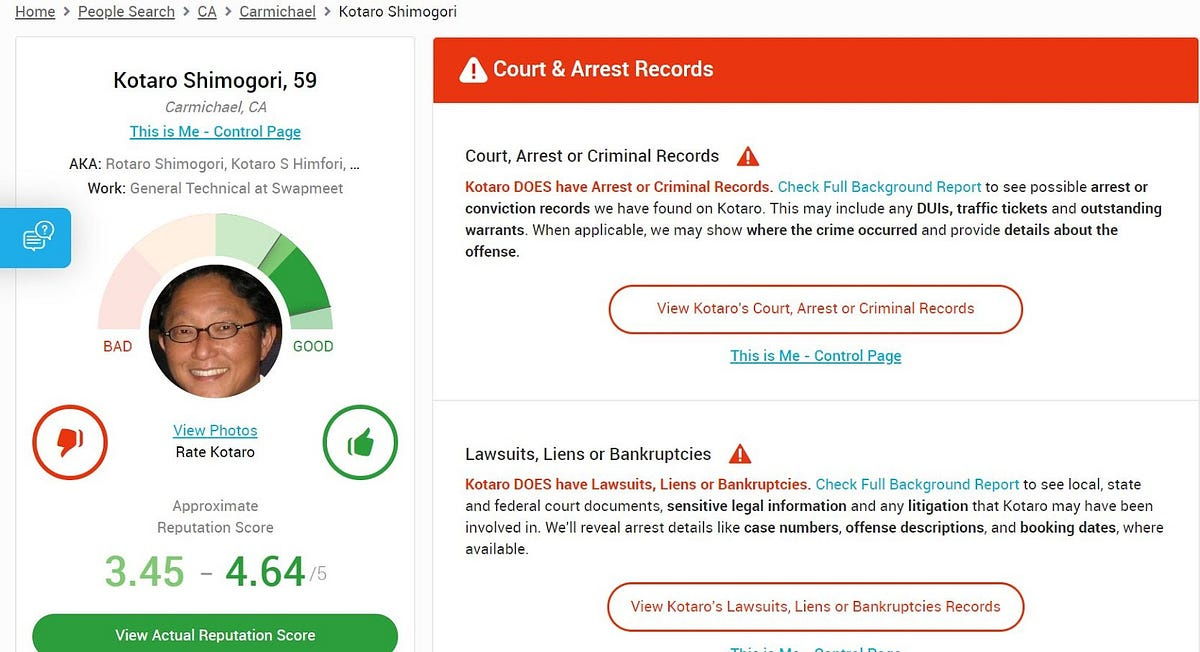

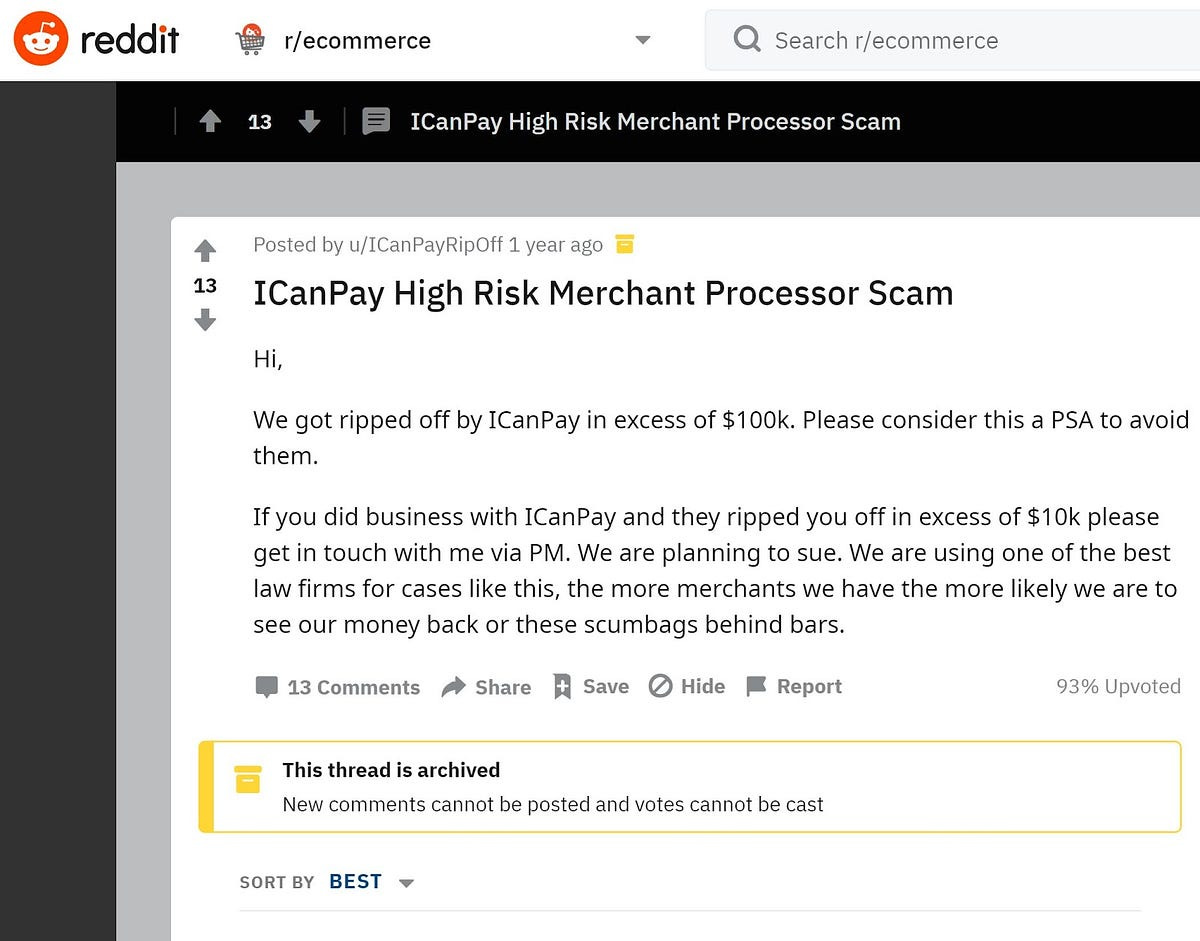

Kotaro Shimogori of ICanPay has stolen in excess of $500000.00+ from merchants who obtained merchant processing from one of his companies. No reason has been given for the theft of funds, outside of a story about his bank allegedly freezing his funds. He has become unresponsive to all attempts to contact him. His companies continue to process credit card transactions.

It was only in 2018, that I found the above alert against “Kotaro Shimogori.” I also found a Reddit string titled: iCanPay High-Risk Merchant Processor Scam.

We were one of many victims.

To accept credit card payments online, a handful of CBD vendors turned to overseas processing companies that are not under the U.S. government’s jurisdiction.

Adds Kight, “the lack of meaningful merchant processing options for participants in the hemp/CBD industry has led to a growth in offshore providers to fill the gap.”

Overseas services can be costly, though. They will charge anywhere from 5% to 10%. That’s just the fee per transaction in the merchant account for CBD products. In comparison, mainstream processors swipe rates are as low as 2.4%

And as we discovered, seeking services elsewhere opened companies to being ripped off. We tried a bank in China, which ended up robbing loss of $20,000 and when I pressed them, they shut down my accounts. It turned out the company, “ICanPay,” was connected to a shady character in Florida by the name of Jonathan Datarshti, who, it turns out, had a ton of complaints against him.

When we tried to recuperate our money, the representative who responded was named Bruce fuckin’ Lee. I wrote again, telling them this was damaging and unacceptable, but iCanPay apparently didn’t like what I wrote because we were swiftly informed that they were going to shut down our account altogether.

Wait, what? Were we dealing with commies? Technofascists? A band of bullies? Malignant narcissists? Scammers? All of the above?

Based on these shenanigans, I consulted with my mentor, who quickly unearthed some shady shit: there were two similarly named companies — iCanPay and iCannPay — registered in the district of Guangzhou Shi, and iCanPay already had several complaints against it.

“What if they are getting ready to flip? Fold the first iCanPay and start all over again,” he told me. I was not versed in the world of crime.

He also remarked that the name Kotaro Shimogori, listed as the main point of contact for the company, was a Japanese name with no digital footprint, another big red flag.

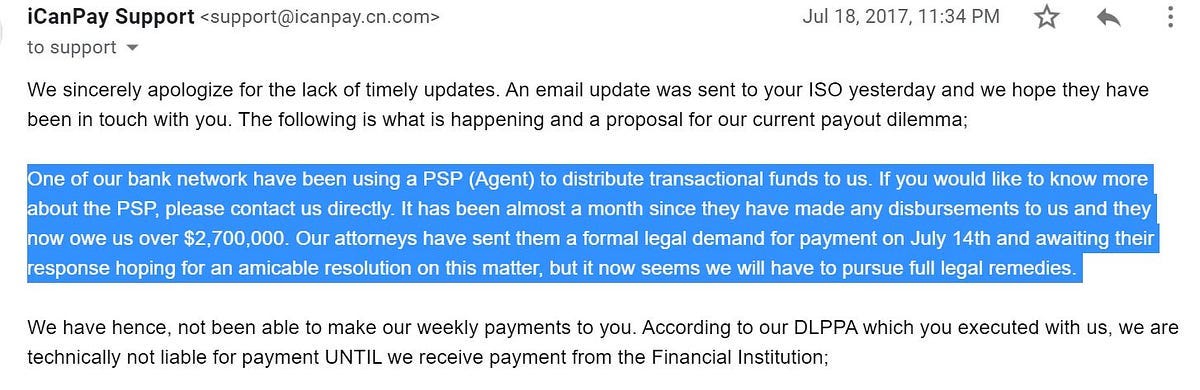

Another month passed without receiving that $5,000 and now iCanPay owed us another $14,000. I decided to unilaterally pull out of China. But before I could, we received a nondescript email from iCanPay support, informing us that there would be a greater delay in our payouts.

I had no idea what a “PSP” was. It was August 2017, and I was out of the country living my digital nomad existence, studying blue zones and longevity. I was in the northern part of Ikaria in a small bed-and-breakfast. Regardless of the country, I was planted — as usual — in front of a computer and desk; this one faced a small balcony that overlooked Messakti beach in the seaside village of Armenistis. The moon was reflecting on the water, and I could hear music drifting up from Ammos, a chill beach bar, equal parts sand and palm fronds, below and to my left. I so wished I was dancing carefree.

But instead, I sparked up Skype to contact the Walters Law Group, the firm in Florida. The “merchant processor facilitator” had accidentally attached a letter from the firm supposedly handling the case.

By the sounds of it, we weren’t going to get our hard-earned dough because some guy by the name of “Jonathan Dardashti,” director of some company called PiroPay in Miami, was holding almost 3 million of iCanPay’s funds.

Was this a case of scammers scamming scammers?

When the receptionist asked who I was, I didn’t know how to identify myself, so I stated that I was both a journalist and a business owner waiting for much-needed funds. She came off as suspicious and standoffish.

Within 30 minutes, Kataro instructed my CFO that we were not to contact their counsel.

I didn’t want their bloody counsel, I wanted to tell them that unless they gave us our funds, I would expose the whole gang to the press, the FBI, CIA, U.S. Secret Service, the BBB, the Internet Crime Complaint Center, and whatever other appropriate acronyms I could file with.

But my operations team urged me to play nice. They actually thought iCanPay would pay us back; I thought we were dealing with a bunch of crooks.

Months later, Kataro sent an email, claiming that there was an accounting error, and that iCanPay only owed us half of the $19,532.22. When I logged on to their portal, they had cooked the books.

Later when I looked into Jonathan Dardashti, aka Yehonatan Yoel, I learned that he too was no stranger to illegal activities. The Israeli who’d migrated to Miami and whose dad was accused of running an illegal ibogaine clinic, was also associated with money laundering and tax evasion.

I stumbled on a site called DardashtiComplaints:

“There have been many unresolved complaints with regards to PiroPay and their withholding funds, sometimes indefinitely, from businesses and individuals alike, and it’s entirely likely that this has been a means of profiteering for quite some time,” according to a post titled Jonathan Dardashti, Payment Processing Theft And Links To Other Business, which has since been scrubbed.

When I looked for Dardashti on Twitter (which is now a suspended site), he described himself as “a Miami-based investor, entrepreneur, and mentor.” He looked more like a hustling cocaine-snorting playboy to me.

After I followed him, I stumbled on some blog posts he’d written such as Wisdom From A Wisdom Tooth, dated June 2016, that read more like a deep thought by Jack Handy than a gold nugget shared by a mastermind criminal or big-time entrepreneur.

Maybe he was an idiot savant? I tweeted to find out but while he initially responded, I never heard back from him after that. And then he disappeared.

Eventually, we switched to T1 Payments, another offshore solution but out of the U.K., notorious in the online world of CBD.

Fast forward to December 2017 when T1 sent us an email, announcing that the Simply Transformative website had been flagged. We needed to fix a few things immediately to stay in good standing.

To meet compliance requests, we were asked to “remove all reviews referring to illnesses (e.g. cancer) as it refers to such possible treatments with CBD products.” They also asked us to remove links to studies because “the FDA does not approve research that can be biased.”

“The FDA does not approve of research that can be biased.” I repeated the last sentence to myself out loud.

We made the changes right away. But I also called T1’s office in Boca Raton to get more information.

I explained that I understood that in the health and wellness space we cannot make claims for fear of the FDA and Big Pharma. However, as a journalist who believes in the First Amendment, I had issues with scrubbing words out of other people’s mouths and altering testimonials.

“These are the compliance requests. They’re not negotiable.” The manager sounded gruff and nonplussed.

“How can the FDA dictate what is bias when they’re the ones frolicking in bed with Big Pharma? How about Pubmed or NIH? Those are government sites; do I have to strip those links, too?”

The manager said he’d get back to me the next day with more specifics. But that evening, when I went to refund a customer, I learned T1 had locked us out of their portal and left us in the dark. Permanently. I no longer had a way to cross-reference transactions or even verify how much of our money they were holding onto. I suspected they were sitting on 10k and waited four entire months to find out it was actually 15k.

Later, when I looked into CEO Donald Kasdon, I learned that he too had a criminal record and a handful of complaints against him on Ripoff Report. It seemed being a slimeball was a prerequisite for working behind the scenes in CBD.

One person on Ripoff stated that when he called to speak to Kasdon, he informed him that he could do “whatever the f&%k he wanted” and that in fact, he was God.

Six months later, T1 only returned half our money.

Plant In Perspective: SAFE or Not?

The SAFE Banking Act (also referred to as H. R. 1595) just passed the House on September 25th, 2019. Generally speaking, it prohibits a federal banking regulator from penalizing a bank solely for providing banking services to a legitimate (ie, state-legal) marijuana-related business.

The bill was endorsed by the American Bankers Association, the Independent Community Bankers of America, and the Credit Union National Association.

“Today’s vote is historic,” stated Democratic representative Earl Blumenauer of Oregon, founder, and co-chair of the Congressional cannabis caucus.

“The House of Representatives took the most significant step thus far in addressing our outdated and out-of-touch federal cannabis laws.”

But like Blumenauer himself acknowledges, this is just the beginning.

Andy Arnold, a correspondent for CBD-Intel US, points out that it still has to get through the Senate and the White House where it’s expected to face resistance.

Legalization advocates have long speculated that the crackdown on pot is merely an attempt to squelch any competition, writes Jim Marrs in his book Population Control: How Corporate Owners Are Killing Us.

Indeed the fight against cannabis, which in part strangely includes non-psychoactive CBD, has been nearly a 100-year-old nuanced crusade.

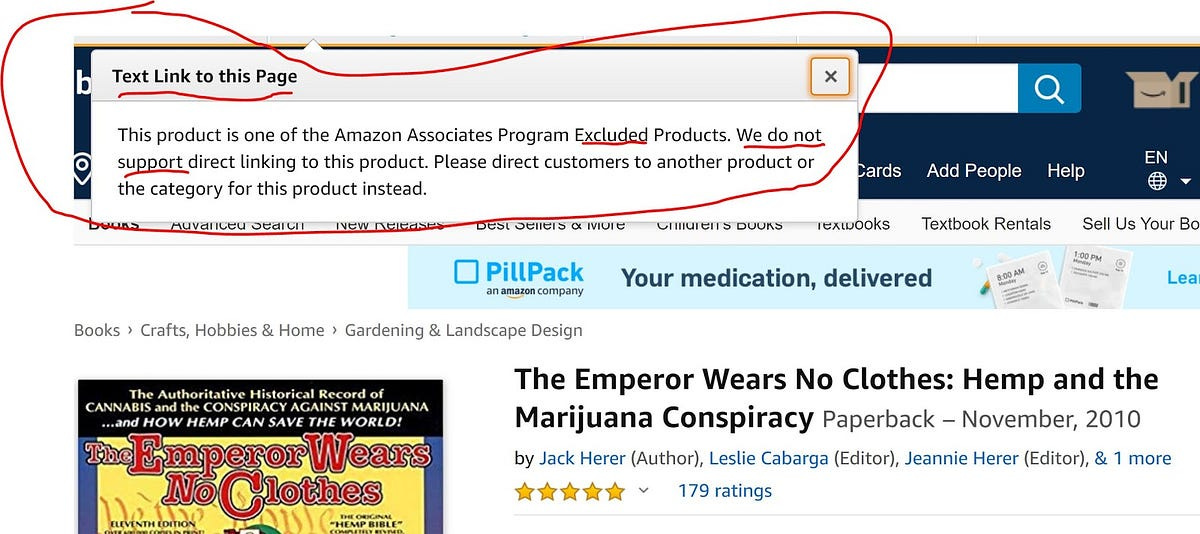

According to ‘marijuana crusader’ Jack Herer and author of the book The Emperor Wears No Clothes, the Hearst and DuPont families wanted to prohibit pot and all forms of hemp-based on commercial motives.

(By the way, in these technofascist times, Amazon no longer offers this book directly from its site. As of late, they’ve deleted many titles that do not tow the Big Pharma narrative.)

Cannabis has been controlled by the government since the enactment of the 1937 Marihuana Tax Stamp Act, drafted by well-known prohibitionist Harry Anslinger.

Anslinger was the first commissioner of the U.S. Treasury Department’s Federal Bureau of Narcotics — pre-DEA — during the presidencies of Hoover, Roosevelt, Truman, Eisenhower, and Kennedy. He ran the show for more than 30 decades, contributing to how culture perceives cannabis and how it got this unjust classification in the first place. (An excellent read is Laura Smith’s How a racist hate-monger masterminded America’s War on Drugs.)

Anslinger didn’t have a shortage of apparent vehemence toward cannabis. Or hippies and negroes.

Smith notes that in 1937, Anslinger wrote an article about the scourge of weed, titled Marijuana, Assassin of Youth.

“The Nixon campaign in 1968, and the Nixon White House after that had two enemies: the antiwar left and black people,” former Nixon domestic policy chief John Ehrlichman told writer Dan Baum for the April 2016 cover of Harper’s.

Ehrlichman continues: “You understand what I’m saying? We knew we couldn’t make it illegal to be either against the war or black, but by getting the public to associate the hippies with marijuana and blacks with heroin. And then criminalizing both heavily, we could disrupt those communities,” Ehrlichman said. “We could arrest their leaders, raid their homes, break up their meetings, and vilify them night after night on the evening news. Did we know we were lying about the drugs? Of course, we did.”

Propaganda-leaning articles proclaiming the dangers of pot ran in papers all across the country. Yesterday’s yellow journalism is today’s fake news.

“It was during this time that anti-drug zealots swapped the term “cannabis” for “marihuana” or “marijuana,” hoping that the Spanish word would conjure anti-Mexican sentiment, writes Smith.

In 1971, Nixon declared a “war on drugs.”

CBD Takeover: Big Pharma Makes Its Move With Epidiolex

After years of angling to take control of the CBD oil market, the FDA — as insiders expected — officially approved the sale of Epidiolex on June 27th, 2018, making it the first oral synthetic CBD drug on the U.S. market derived from the cannabis plant. The beneficiary? Big Pharma, naturally.

According to Hemp News, in December 2016 an 118-page report containing memos between the DEA’s chief, two FDA officials, the governors of Rhode Island and Washington and other government officials were leaked, hinting to collusion.

One of the reasons the FDA came to their decision is because “Individuals are taking the substance on their own initiative rather than on the basis of the medical advice from a practitioner licensed by law to administer such substances,” officials wrote in a summary.

In a letter to the DEA Chief Chuck Rosenberg, Acting Secretary of Health Karen DeSalvo for then Obama administration (ironically newly appointed as Google’s first-ever chief health officer)

recommended that marijuana should maintain its Schedule 1 status, because, she wrote:

“Marijuana has a high potential for abuse, no currently accepted medical use in treatment in the United States, and a lack of accepted safety for use under medical supervision. Accordingly, HHS recommends that marijuana be maintained in Schedule I of the CSA.” (The same HHS that patented the plant.)

Epidiolex is manufactured by Britain’s mega-giant GW Pharmaceuticals. Incidentally, GW Pharma has an “exclusive marketing agreement” with Bayer, prominently featured in my documentary Vanishing of the Bees as the main monolithic Big Pharma/Big Ag company responsible for creating systemic pesticides that are slowly killing honeybees, birds, butterflies, bats, worms, humans and aquatic life.

What were the chances of sharing bees and bud in common with Bayer?

Epiodelex is marketed for use in the treatment of seizures associated with childhood epilepsy. According to The New York Times, Epidiolex is expected to cost U.S. patients between $2,500 to $5,000 a month. Initially.

The thing is, real CBD oil, as a dietary supplement, has been used successfully for the treatment of seizures associated with childhood epilepsy for many years — at a fraction of the projected Big Pharma price tag.

For the past 22 years, pediatric physician Dr. David Sine who practices in Central California has treated children with special needs, as well as hospice patients. Six and a half years ago, he began using different CBD blends. More than 100 children later, he has yet to have a patient who did not benefit from (natural) CBD oil.

“The plan was for GW Pharma to patent and OWN CBD hemp oil in this country,” says Kim Paddock who sued Gov. Butch Otter (ID) in federal court for the right to have CBD oil in 2017. The suit outlines how Dr. Robert Wechsler (a pediatrician who “treats” children with epilepsy) took some $223,000 from GW Pharma to help keep CBD out of Idaho and to push their CBD drug, Epidiolex.

Paddock adds that Idaho laws regarding cannabis were written so that they contradict each other and in essence make ALL cannabis illegal. Idaho confiscated a 1.3 million dollar LEGAL load of hemp this year.

Epidiolex has now partnered up with the Epilepsy Foundation, which will surely amount to tons of new customers. Ka-ching.

In addition to Epidiolex, GW Pharma, with the help of the U.S. Patent and Trademark Office, owns eight patents with another 22 pending for the treatment of a number of conditions including cancer, constipation, general pain, and nausea, as well as for the methods of extraction, proprietary uses, and hybrid strains of cannabis.

Big Pharma’s method of operation is to synthesize, patent, and control. Epidolex is synthetic isolate with other ingredients that aren’t listed. The result is a version of CBD that doesn’t support the entourage effect, the understanding that all of the plant works together to do its work.

It may sound like a Michael Crichton techno-thriller, “but the entourage effect is serious business and can make the difference between CBD providing immense health benefits and doing nothing at all,” contends Master Herbalist Elizabeth Moriarty.

In whole plant (non-conventional) medicine, the entourage effect refers to hundreds of natural components within a plant interacting together and with the human body to produce a stronger impact than with any one of those components used alone. The combination of these multiple compounds in their natural state is what produces a synergy.

Compare this to conventional medicines that focus on extracting single compounds from a plant and isolating or producing the active ingredient in a laboratory then selling it to you in the form of pills and powders.

“Big Pharma does not understand botanical medicine,” said Ethan Russo in an Undark article. Russo is a neurologist and former medical advisor at GW Pharmaceuticals who now serves as director of research and development at the International Cannabis and Cannabinoids Institute. Undark focuses on the intersection of science and society. “I can tell you having worked with GW, they were sure aware of (the entourage effect).”

But apparently, they chose to ignore it.

Cash Advance Loans: “Sign Here To Lose Everything”

“We can get you your money today! No cost or obligation to get an offer.”

“No Risk! Contact Us Now!”

“Still In The Market? Contact Capital Boom Funding.”

When you lose about $15,00 to $20,000 in sales every week, and don’t have a processor, purchasing inventory and fulfilling orders becomes impossible. Angry complaints are filed with the Better Business Bureau and chargebacks start rolling in. By June of 2017, HoneyColony LLC approximated about $140,000 in lost sales and damages. We needed cash and fast.

It was as though we’d let out a scent of desperation to hungry crooked fiends. Magically, “funding companies” contacted us out of thin air. We’d popped up on some map that identifies when small companies in a danger zone. Our CFO rejected so many offers and yet they continued to text, call, and email. They still do to this day.

This is where we, unfortunately, took a turn down another dark alley where I discovered an equally crooked bunch: the ‘merchant cash-advance’ industry, which often turns out to be a small business’s death knell.

Later in December 2018, I would discover that Bloomberg News had just run an excellent series on how these predatory lending entities manage to chew small businesses across America with the help of one East-coast state.

The lenders choose New York courts because state law is especially friendly to “confessions of judgment,” an agreement signed by clients that prevent them from seeking redress in court. No matter where they’re located or who they’re giving money to, cash-advance companies can avoid restrictions by filing their cases in New York.

“Behind it all [is] a group of financiers who lend money at interest rates higher than those once demanded by Mafia loan sharks,” writes Zachary Mider and Zeke Faux in the Bloomberg series titled “I Hereby Confess Judgement.” “Rather than breaking legs, these lenders have co-opted New York’s court system and turned it into a high-speed debt-collection machine. Government officials enable the whole scheme. A few are even getting rich doing it.”

This dog-eats-dog industry got big after the U.S. financial crisis a little over a decade ago. Telephone salesmen who are both aggressive and dripping with fake sympathy offer small businesses fast money at costs you later discover are crazy.

The rates sometimes exceed 400 percent a year, and daily payments are required, but borrowers [are] desperate.

We sure were.

We ended up dealing with not one but three entities: Lendini, Quarterspot, and Yellowstone Capital. The latter is one of the more notorious lenders that operate “out of a red-walled office above an Irish bar in New York’s financial district…”

They lent us, $40,000, $36,000 dollars, and $30,000, respectively. And without my knowing, I became personally liable for outrageous terms while thinking I was protected by the LLC, which is supposed to offer business owners protection from financial decimation.

Turns out, cash advance loans get around usury laws by saying they aren’t making loans but advancing cash in exchange for a share of future revenue.

To get the party started, lenders require borrowers to sign “a confession of judgment,” stating that the borrower has agreed in advance to lose any court dispute about the transaction.

The confessions are signed months before any case exists and before any payments are missed. These are sometimes signed without the person’s knowledge or consent. In reality, no proof of missed payments is required for things to get ugly and fast.

Borrowers have accused lenders of forgery before. One of our signed documents did not include my actual signature and was dated July 12, 2017, out of NY during a time when I was living in Greece.

Bloomberg reports that New York State court cases were filed by more than 350 cash-advance companies since the industry began using confessions around 2012. It found more than 25,000 such cases entered in courts around the state, most of them in the past two years, involving lenders and borrowers from all over the country. The judgments are worth an estimated $1.5 billion.

The three lenders we signed up with were deducting a total of $1400 a day, five days a week directly from our bank account. This became unsustainable when Bruce Lee & Friends robbed us 18k.

We tried to negotiate, asking for leniency to plan properly to survive and operate the business on a day-to-day basis. But the loan sharks didn’t go for it. Maybe they anticipated what would come next?

The constructs of this industry comprise a zero-sum game and a soon-to-be negative balance.

Continued attempts at $1400 a day would drain our bank account and cause other transactions to bounce, resulting in more disruptions, fees, and headaches.

But my mentor strongly advised my team and me not to close our bank account and mentioned the word ‘liens,’ which I admit, I didn’t know the meaning of.

The whole cash advance world was rigged — a demented domino game toward a company’s death. Seemed we were screwed either way:

Each failed attempt to withdraw money by these guys, my mentor explained, could trigger bank fees, legal fees, and penalties against us, equating to hundreds if not thousands more lost.

I was still out of the country when my CFO closed our bank account despite counsel and without my knowledge.

“Don’t you get it, you’ve been left holding the bag,” my mentor informed me.

I got back to Los Angeles shortly thereafter and fired the operations team. The following day, I started getting threatening calls from collection agencies working on behalf of the cash advance places. The loan sharks for the loan sharks, if you will. These agents were shrewd, menacing, and mafioso-like, with thick New York accents and ice-cold hearts.

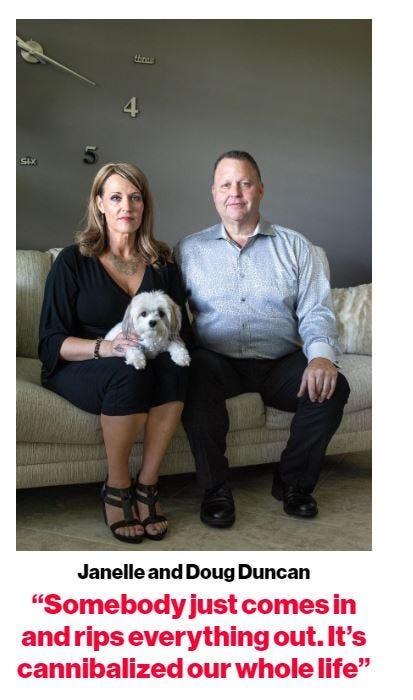

“You can’t defend yourself,” Richard Schilg, the owner of a human resources company in Ohio who borrowed hundreds of thousands of dollars with at least six advances told Bloomberg. “As long as you still have a business, as long you have a personal checking account, they’re going to hound you. Your life is ruined by their contract.”

Schilg always tried to honor his debts. But his access to money was so restricted by cash-advance judgments that he sold furniture to buy food.

“I will make this my personal business to f — — you,” a Yellowstone executive told him, on a voicemail heard by Businessweek.

A few days following the bank closure of a five-year-old account, I received this notification:

We’re contacting you and HoneyColony via email to let you know that we received a UCC Lien Notice from Loan Sharks R Us LLC dba ConArtistitus that affects your Account. A UCC Lien Notice is the legal seizure of property or personal Accounts to satisfy a debt.

So that’s what a lien is, I sarcastically thought to myself. A lien was placed on our existing bank account, as well as on my own account. I had one personal account they had not seized; I withdrew my funds and hid my money in a friend’s unused bank account. Welcome home! I had been back in the good ole U.S. of A. less than a week.

The day after that, I woke up to find that Lendini had also seized $7,000 from our PayPal account. Next, Yellowstone also placed liens on each of our merchant processors. Yellowstone’s collection agency seized $13,000 and filed a lawsuit in the state of New York against HoneyColony and me.

Later that afternoon, upon returning from an errand, I found a note literally taped to my door from Quarterspot, which was based out of Virginia. They wanted me to contact them. Had I just missed the goon who personally delivered the letter? Did he carry a roll of Scotch tape on him at all times? I hated to think about what else he might have carried on him.

Business owners have been known to end up in the hospital due to the stress only to find out they no longer can afford health coverage.

I called the number on a letter I received from Vadim Barbarovich, a “New York City marshal” to see if he could give us back some of our funds. I got him on the phone and in a Russian accent, he basically told me “no can do.”

Thanks to the Bloomberg series, I learned that before Vadim was appointed in 2013, he’d tracked inventory at a Brooklyn hospital and volunteered as a Russian translator. Now he was the go-to marshal for the cash-advance business and has gotten rich in the process. Last year, city records show, he cleared $1.7 million.

“New York’s 35 marshals are government officers, appointed by the mayor, who collect private debts. They evict tenants and tow cars, city badges dangling from their necks. When they recover money, they get a fee of 5 percent. The office dates to Dutch colonial days, formed by a decree of Peter Stuyvesant’s council,” writes Bloomberg.

This arcane feature of the city’s government is another powerful tool for cash-advance companies.

Barbarovich is the dude who issues the legal order, demanding money from said bank. By law, New York marshals’ authority is limited to the city’s five boroughs, but here another loophole helps the industry: They’re allowed to demand out-of-state funds as long as the bank has an office in the city. Most banks just hand over their customers’ money. Ours did.

Most companies that are subject to this legal scam go under. I did a forensic deep dive to put Humpty Dumpty back again and somehow we survived.

Update: On November 7th, Bloomberg’s Zachary Mider was thoughtful enough to update me on my ‘pal’ Vadim via email.

“The city’s Department of Investigation said Thursday that Marshal Vadim Barbarovich would step down after the agency concluded he had violated debt collection rules and was “untruthful” with investigators.”

Technofascism Along The Bleeding Edge Of CBD

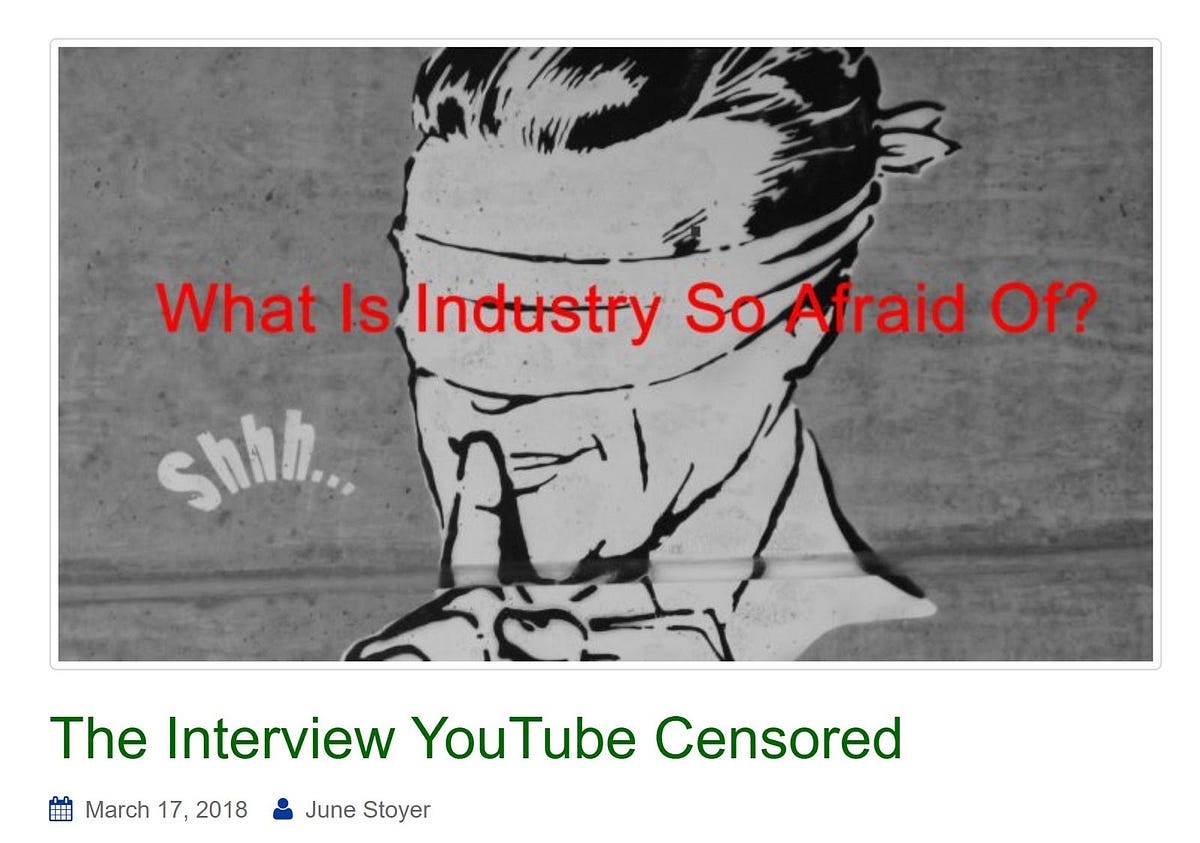

“Just to let you know, our interview was flagged by Youtube,” June Stoyer, a journalist, told me via email.

It was March 2018. Back then, flagging was still novel.

After YouTube yanked our interview from her channel The Organic View where she has 1.44k subscribers, Stoyer was also temporarily banned from Twitter.

It’s worth mentioning that Stoyer is also a long-time environmental activist, and even more vocal than I am against systemic pesticides and Bayer. She was probably already on some Bayer shit list.

We’d been discussing the politics of CBD.

“If I am flagged again, they can shut down the entire channel. I thought you would want to know because this could severely have a negative impact on all of my work for the last decade.”

I felt ashamed. Infected.

It was then May 2018, and a few months later, I myself received an email from YouTube alerting me that a video I’d filmed back in 2016 promoting the benefits of our Superior CBD oil was flagged and removed.

Even Kight scratched his head as to why it was taken down since nothing in the video is inflammatory.

In 2019, we knew that YouTube didn’t need to give you a reason — a blanket “You’ve violated our terms” is all you get.

“Youtube content creators are getting increasingly frustrated at the fact that YouTube is applying vague rules arbitrarily,” adds Google Whistleblower Zach Vorhies. “Instead of citing why a video was taken down, YouTube instead will say it violated their rules. Which rules? YouTube refuses to say and the content creator will never know.”

This is when I first wondered if something had happened to the First Amendment. And latched on to the term ‘technofascism.’

Luisa Benton (not her real name) was also marketing her company’s perfectly legal hemp-derived CBD products via a well-established YouTube channel. All that changed one day when YouTube unceremoniously terminated their channel without notification or a chance to fix it to adhere to any guidelines.

“Our CEO went to pitch our brand to a potential investor and all of our videos on our website were missing,” says Benton. “That was our first indication YouTube had a problem with us.”

Many channels have had to change paths when it comes to content or the ways they present theirs, often causing harm to the very people YouTube claims to want to protect in the first place, adds Mc of Natural Healthy CBD.

It was sometime around Google’s “Medic Update” that I also noticed that we could no longer search for CBD-related key terms via Google’s web planner, which we used for SEO.

Fast Forward to November 2019, and there was a culling of CBD videos on Google/YouTube.

“The truth is Google wants total control of business relationships on Youtube and the Internet,” adds Mc. In 2018, her CBD company was one of two privately sponsoring YouTubers.

“What happens the day your channel is suspended and deleted from Youtube? What do you do? Who do you tell? What if Facebook bans you? Then Twitter?” writes Mc. “Your phone goes off to alert you that your bank account has been shut down and so has your Paypal. . . . Who do you tell? Who would believe you? Is there still time to save free speech on the internet?”

Demonetization, shadowbanning, blacklists, dwindling subscribers in real-time, and channel terminations have become normalized. Anyone who has a business or vocation that challenges the status quo is experiencing digital assassinations.

Death By a Thousand Bits

“How can anyone invest in any business knowing that at any point Google [or other Big Tech companies] can just throw a kill switch and then destroy your business,” adds Google Whistleblower Vorhies. “ You’re just going to live with financial installability, insolvencies based on the fact that no one can find your website anymore.”

Beyond CBD, Big Pharma today has permeated countless Big Tech companies, including social media platforms-turned-publishers. i.e. Google, Facebook, Mailchimp, Vimeo, and GoFundme.

I was scrubbed off of GoFundMe in 2017. An investment group known as Accel Partners acquired the ‘crowd-sourcing platform’ for $600 million back in 2015. Accel has its money in Facebook, Venmo, Spotify, Slack, Etsy, Dropbox, Vox Media, Docusign, Dropbox, and more — many vehicles that track data, human behavior, information, and consumption. Accel also invests in “health care.”

GoFundMe recently announced that the crowdfunding platform is purging all users from its site who attempt to raise money for causes that in any way call into question the safety and efficacy of vaccines?

CBD Falls Under The Purview Of The Federal Drug Association (FDA)

On December 20, 2018, Trump signed the 2018 Farm Bill (also known as AIA), legalizing hemp and with it the highly-touted wellness ingredient CBD.

Hemp was now permanently removed from the Controlled Substance Act CSA. Finally deemed an agriculture commodity, no longer mistaken as a controlled substance, like marijuana.

After nearly two and a half years of endless obstruction, many companies, including HoneyColony, made US history by becoming one of the first online companies to sell CBD to sign on with Elavon/US Bank, the fifth-largest bank in the nation. Finally, we could process orders for CBD products without fear of repercussions. The hemp industry meanwhile saw the passage of the Farm Bill as a green light and a burst of hemp-derived CBD products have hit the market.

“This [new bill] ended a multi-decade prohibition on hemp,” stated Jonathan Miller who serves as general counsel to the U.S. Hemp Roundtable, a coalition of dozens of hemp companies.

But had it? Was this a marvelous case of Peripeteia? Or decades of incubation and part of Big Pharma’s sinister plan?

On May 15, 2019, US Bank backed out and dropped approximately 1,000 accounts, leaving them all scrambling for a processor. Yet again. The supposed reason: financial institutions had not yet caught up with legal and regulatory compliance. Rules were still being drafted.

Meanwhile, the very day the AIA was signed into law, CBD strategically fell under the purview of the U.S. Food And Drug Administration (FDA). Nicely played.

In fact, the FDA issued an immediate online press release, stating that, “it’s unlawful under the FD&C Act to introduce food containing added CBD or THC into interstate commerce, or to market CBD or THC products as, or in, dietary supplements, regardless of whether the substances are hemp-derived.”

“This is arguably the biggest issue currently facing CBD,” states Kight.

The FDA purports itself to be a consumer protection agency that protects and promotes public health through oversight of a broad range of products that account for more than $2.5 trillion of consumer spending.

“Conveniently, the FDA contends that, since CBD is the compound at issue in the approved medication Epidiolex (the fake synthetic CBD), it cannot be used as an ingredient in food or marketed as a dietary supplement.”

A good analogy now that CBD is magically no longer a natural compound but a drug, is like putting Ativan in salad dressing and then selling it. The notion is ridiculous of course, given the plant compound’s established healing profile.

“Obviously, there are significant differences between CBD and Ativan,” says Kight, “but … since CBD is [now] an approved drug, it cannot be used in food.”

Kight also argues that FDA statement is inaccurate.

because “CBD is a naturally occurring constituent inherent in hemp, which has been marketed and used at least since the Civil War. The prohibition on marketing a drug in food applies only to a substance that is added to food and does not apply to a substance that is in food, even where the substance is identical to an approved drug.”

Fake CBD News: Framing The Narrative With Misinformation

“The food with its strange evil tastes? Why should one feel it to be intolerable unless one had some kind of ancestral memory that things had once been different?” George Orwell, 1984

On May 31st, the FDA held its first-ever public hearing on the future of CBD derived from hemp. The event, which lasted 10 hours and could be seen via live stream, heard testimonies from more than 100 researchers, big pharma officials, advocates, manufacturers, and opponents. Topics covered included benefits, manufacturing, product quality, marketing, labeling, and sales of CBD-infused retail products.

My personal takeaway after tuning in for hours online is that Big Pharma/FDA is spreading disinformation, claiming that the hype outweighs the science.

FDA Acting Commissioner Ned Sharpless kicked off the hearing by stating that “we’ve seen an explosion of interest in products including CBD, [but] there is much we don’t know.”

Wrong.

There’s a lot that we do know. Government officials and Big Pharma reps would just like the masses to think otherwise.

The World Health Organization (WHO) has issued two reports in the past year which found that CBD is safe, non-toxic, non-addictive, non-psychoactive, and has significant potential as a health aid. (Incidentally, the same report does refer to pharmaceuticals such as GW developing ‘pure’ CBD products.

Meanwhile, the health benefits of CBD have been established by a variety of studies. The irony is that government red tape is what stifles more independent research from going forward, to begin with.

“Since this keeps coming up; for those of you that believe or repeat the falsehood that cannabis ‘simply hasn’t been researched,’ there is plenty of research,” says Moriarty. “There are plenty of clinical trials in the US alone and in other nations as well.”

The rewriting of truth is Orwellian. This disinformation is perpetuated by mainstream media presstitutes who repeat rather than report.

Fifty-nine million results in 0.46 seconds. That’s how many hits Google lists with the search term “CBD has the potential to harm you” as part of the new pharma-inspired and media-orchestrated onslaught against independent CBD entrepreneurs and common sense in general.

For instance, Buzzfeed reported:

(buzzfeed.com)

Wrong! Don’t believe Doogie! Or most of the mainstream media these days. According to many ‘popular’ outlets, it would seem like people are putting themselves at risk — or at the very least, wasting your money- if you buy a CBD dietary supplement. This is what would be dubbed today as “alternative facts,” “false narratives,” or “fake news.”

With this said, there is no shortage of shoddy products and slimy people in the CBD dietary supplement space that tarnish the industry. Currently, commercially marketed CBD-infused products are not subject to explicit federal regulations.

Some commercial products have been identified as containing unwanted and potentially dangerous adulterants as well as heavy metals and solvents.

“The rapidly evolving hemp-derived CBD marketplace sadly includes a number of bad-faith actors selling the equivalent of modern-day snake oil,” says NORML Political Director Justin Strekal.

The abuse and greed in the marketplace paints a picture of negligence and gives the FDA justification to step in.

“American patients and consumers can have confidence that an FDA-approved drug has undergone a rigorous scientific and medical review to ensure that it works correctly and that its health benefits [that] outweigh its known and potential risks for each approved use,” Schiller also stated in his speech. “The approval process protects patents against quackery and fraud…”

While regulation and the welfare of the people are certainly paramount, the FDA is not the poster child for safety it pretends itself to be.

America is the most medicated nation on earth, with some 70 percent taking prescription drugs — yet we have worse health outcomes than other industrialized countries.

According to a 2011 report by the Institute for Safe Medication Practices, prescription drugs were associated with two to four million people in the U.S. that year, experiencing “serious, disabling, or fatal injuries, including 128,000 deaths.”

Although official statistics claim that around 64,000 Americans died from a drug overdose in 2016, it’s estimated that the real number is 10 times greater and that’s from drugs being prescribed and taken properly (ie FDA-approved), according to an October 2018 issue of What Doctors Don’t Tell You.

CBD In The Here And Now

Selling CBD online is not for the faint of heart. One needs to be an entrepreneurial MacGyver.

On September 17, Senate Majority Leader Mitch McConnell proposed language that directs the FDA to issue policies on regulating and enforcing regulations on the use hemp-derived CBD” in products,” according to JDSUPRA, a daily source of legal intelligence on all topics business and personal.

“It is vital to remember that hemp’s […] healing properties date back 4,000 years,” says Jenelle Kim, Founder and Chief Formulator of JBK Wellness Labs.

“For a medicinal herb that has been used responsibly for thousands of years as a treatment for pain and fatigue, among other conditions, to be given a larger opportunity is certainly a winning situation for all involved.”

But the FDA disagrees. Schiller told attendees at the recent hemp summit that under current law, it’s unlawful to sell a food or dietary supplement with CBD in interstate commerce.

In the meantime, the USDA established the U.S. Domestic Hemp Production Program to establish a national regulatory framework for hemp production. The Interim Final Rule for Hemp Production was just published in the Federal Register on Oct. 31. The rule immediately went into effect, but public comments will be accepted for 60 days until Dec.30th.

This rule outlines provisions for the USDA to approve plans submitted by States and Indian Tribes for the domestic production of hemp. Will this latest development mark an important step towards the realization of a streamlined domestic — and globalized — hemp industry?

A press release was issued by the Hoban Law Group, a law firm that used to provide expert commercial legal advice to the industrial hemp industry. Now they work for the government.

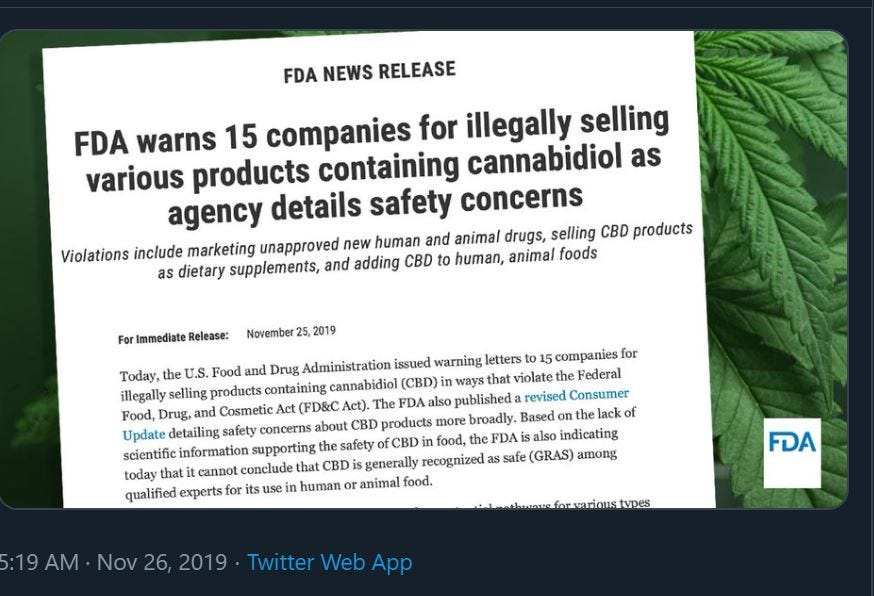

https://twitter.com/FDA_Drug_Info/status/1199316853136515072

On October 10th, The FDA yet again issued warning letters to some makers of CBD topical products, making it very clear that sellers do not have an unfettered pass to offer their products.

The FDA reiterated its position that CBD products cannot be marketed for therapeutic or medical uses without having been reviewed for safety and effectiveness by the FDA — this requirement applies to all CBD products, including topical and cosmetic products,” according to an article in The Canna Law Blog.

The dope-y saga continues.

A Note to the Reader:

Thank you so much for supporting and sharing my work. We rely on the value-for-value model with all of our work that we do. I want to invite you to consider upgrading your subscription to my Substack for as little as $5/month to join in the conversation, comment on all posts, and support independent, investigative journalism that you value. Upgrade as a Founding Member to gain access to a monthly Q&A with me. Thank you to all of you that already support my work in all of the various ways that you do. Remember, just by sharing this content, you are helping immensely.